At a glance

-

Comprehensive and well-founded advice on actuarial issues provided by actuary and pension fund expert

-

Customized and interactive analysis tools e.g., regarding risk management, conversion rate or comparison of pension funds

-

Team of pension fund experts, actuaries and financial market experts specialized in risk management

-

Independence and transparency guaranteed through our ownership structure

-

PPCmetrics is an expert in occupational pension schemes recognized by the OAK pursuant to Art. 52d BVG

Actuarial Consulting

Pension funds face a variety of complex liability-related issues. The economic environment considerably influences financial balance. PPCmetrics offers sound and comprehensive risk management for achieving investment targets.

Our consulting services as an actuary an a pension fund expert include:

- Interactive and comprehensive projection of insured population, balance sheets and profit and loss statement

- Sensitivity analysis with respect to plan components and actuarial assumptions

- Flexible and objectified consideration of accounting principles

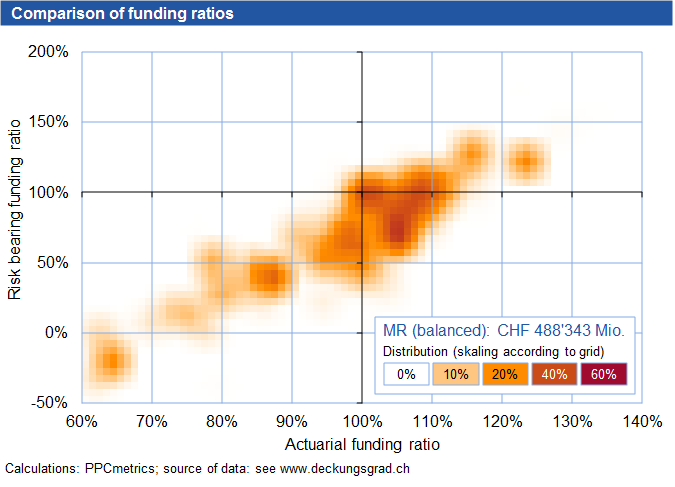

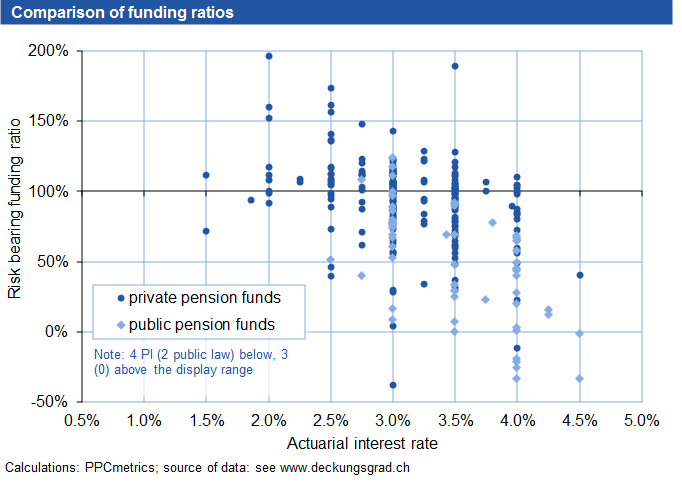

- Analysis of financial balance on the basis of simulations consistent with the financial market

- Comparison of different pension schemes and institutions with a focus on risk management

- Valuable comparison of pension funds thanks to a broad peer group of pension funds

Experts in occupational pension schemes

PPCmetrics is an accredited expert in occupational pension schemes pursuant to Art. 52c BVG.

Our services include:

- Periodic verification according to Art. 52e para. 1 BVG, whether:

- The pension institution offers sufficient security to fulfill the pension commitments

- Actuarial regulations on benefits and funding comply with legal prescriptions

- Drawing up recommendations in line with Art. 52e para. 2a BVG, in particular with regard to the technical interest rate and other technical principles.

- Preparing recommendations according to Art. 52e para. 2b BVG on measures to be taken in case of underfunding as well as evaluating these measures pursuant to Art. 41a BVV 2

Publications

UBS Takeover of Credit Suisse

On the evening of 19 March 2023, UBS announced its intention to fully acquire Credit Suisse in close coordination with the Swiss Financial Market Supervisory Authority (FINMA), the Swiss National Bank (SNB) and the Swiss Confederation. According to the SNB's press release, the transaction is necessary to secure financial stability and protect the Swiss economy. In our presentation, we summarise the most important facts about the takeover as well as possible implications for investors.

Transition from LIBOR and Alternative Reference Rates After the End of 2021

LIBOR will be replaced as the reference interest rate in Switzerland at the end of 2021. We explain the reasons for this, show alternatives and point out possible implications for institutional investors.

PPCmetrics Asset Manager Review 2019/2020 CHF Edition - English Version

Challenges and important aspects of illiquid investments. In the last three years, more than 3’000 investment managers participated in the PPCmetrics market screens. This Asset Manager Review contains information on asset managers for unlisted real estate USA, Swiss Equities Small and Mid Caps, Fund of Hedge Funds and Senior Secured Loans.

Challenges Pension Funds Face due to Low Interest Rates

Risk-averse asset-only investors should go for short duration as risk return is distributed highly asymmetrically.

What can I expect from my pension fund?

Alfred Bühler and Lukas Riesen explain why the risk-bearing funding ratio could become the yardstick for Swiss pension funds.

Is factor-based allocation new?

Factor-based allocation may be theoretically interesting for Swiss pension funds but it is hard to implement in a practical way.

Switzerland: The safe haven trap

Lukas Riesen and Alfred Bühler analyse the consequences for pension funds arising from the flight to ‘safe haven Switzerland’ and present possible solutions for dealing with this risk.

Pricing investment risk

Alfred Bühler and Lukas Riesen analyse the costs that arise by taking investment risk and the way they are shared