At a glance

-

Asset Manager Selection for institutional investors (pension funds, trusts, insurance companies, companies, etc.) and private investors (private investors, family offices, UHNWI)

-

Transparent selection and due diligence of asset managers following the best institutional practice and governance and the principle of an open and free competition and the equal treatment of all participants.

-

Proven experts and great expertise in all asset classes such as equities, bonds (government and corporate bonds), mixed mandates, real estate and alternative investments such as hedge funds, commodities, private equity, insurance linked securities, etc.

-

Long-standing practical experience through successfully concluded public invitations to tender in accordance with Swiss law and international standards (e.g. WTO Argreement on Government Procurement GPA)

-

Combined expertise in economic and legal aspects of asset management, global custody (custodian bank), investment management, etc.

-

Transparent benchmarking of tenders thanks to peer group comparisons

-

Extensive knowledge of the financial industry as a result of our activity as investment consultant and investment controller

-

Independence and strict avoidance of conflicts of interests

Selection of asset manager and custodian bank

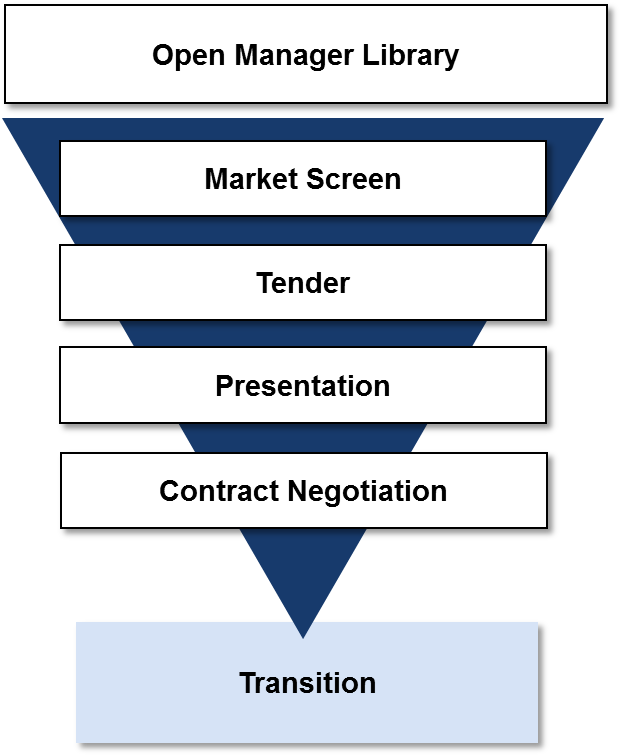

A professional and systematic selection process as well as considerable knowledge of the economic, operational and legal criteria and risks are key issues of a successful selection. We have long-standing experience and expertise in both non-public tendering and public tendering in accordance with the WTO agreement. Our selection process is systematic and clearly structured and allows for the selection of providers in strict adherence to the principle of free and open competition and the equal treatment of all participants. Our selection process adheres rigorously to the requirements of best governance.

Best fit

In our process, we consciously avoid standardized lists, but select possible candidates based on clear guidelines and criteria in terms of best fit. Based on your investment guidelines, the corresponding benchmarks and further specifications of the tendered mandate (asset management, global custody, etc.), we develop a recommendation regarding the requirement profile, the mandate specifications, the legal requirements and specific selection criteria. Important parameters, e.g. admissibility of securities lending, use of derivative instruments, retrocessions, reporting and legal requirements are factored in at an early stage of the selection process and increase the probability of successfully awarding the mandate.

Assessment by expert

The analysis and evaluation is made by proven experts with an excellent education and professional experience. Our expertise is combined with our detailed knowledge of the managers’ investment activities we acquire by our investment controlling as well as our legal know-how. For each asset class there is a specialist supported by several deputies. The partners and employees of PPCmetrics are proven experts and regularly active as consultants/lecturers in their field of expertise. They regularly share their expertise with a broad public by writing various publications. We have been active as investment consultants and controllers for a variety of institutional investors in Switzerland, Germany, Luxembourg and other European countries. Thanks to our long-standing experience as legal consultants, we have broad investment-specific know-how as well as deep knowledge of various legal systems including the Anglo-Saxon common law.

Open selection process

Every tendering process that we conduct is based on our open data base. This data base is regularly updated and currently includes the leading custodian banks as well as more than 1’200 asset managers for various asset classes such as equities, bonds (government and corporate bonds), mixed mandates, real estate, and alternative investments such as hedge funds, commodities, private equity, insurance linked securities, etc.

Every manager can register for free and is systematically considered in the selection process.

Assessment based on clear criteria

The analysis and assessment (tenders, due diligence) are based on clear and structured economic, legal and operational criteria such as:

- High level of stability and specialization of the asset manager or the custodian bank

- Excellent education and professional experience of the responsible people

- Comprehensible investment approach, clearly structured processes and appropriate risk management

- Market-compliant asset management fees, custodian bank fees as well as transparency of costs

- Performance in the past / track record

Best governance

The PPCmetrics selection process adheres rigorously to the requirements of best governance. Written tenders, our evaluation of tenderers, including recommendation and – if required – a presentation by tenderers, enable clients to make an informed and transparent decision when awarding a mandate. The open process, clear criteria and our comprehensive documentation ensures a fully objective and documented conduct. We register the fees offered by tenderers, from contract negotiations we conducted and from the investment controlling mandates. Thus, we have an overview of the current fees as well as the historical development for the evaluation and benchmarking of the tenders. This ensures competitive market conditions for asset management. Our process is rigorously tailored to the needs of our clients.

Interactive tools

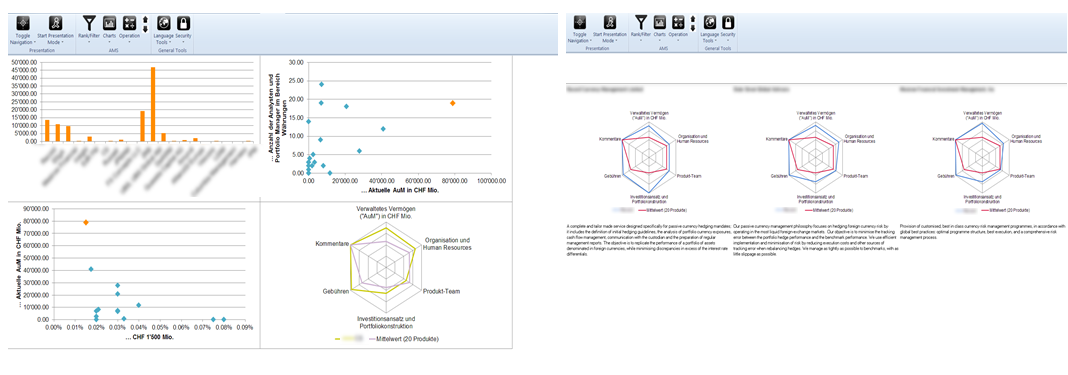

We use advanced tools for analysing the tenderers and a tailored comparison of the asset managers and portfolios as well as the quality of services offered by the custodian banks. We use our proprietary software that we have been developing for several years.

Publications

UBS Takeover of Credit Suisse

On the evening of 19 March 2023, UBS announced its intention to fully acquire Credit Suisse in close coordination with the Swiss Financial Market Supervisory Authority (FINMA), the Swiss National Bank (SNB) and the Swiss Confederation. According to the SNB's press release, the transaction is necessary to secure financial stability and protect the Swiss economy. In our presentation, we summarise the most important facts about the takeover as well as possible implications for investors.

Current Facts About Credit Suisse

Distortions at the banks in the USA as well as statements by major Credit Suisse shareholders led to renewed high price declines in Credit Suisse's bonds and shares. The bank's stability is particularly at risk if it enters a negative spiral and is confronted by a significant outflow of client funds. In a media release on 15 March 2023, the Swiss National Bank SNB and the Swiss Financial Market Supervisory Authority FINMA commented on the uncertainties in the market as well as on Credit Suisse.

Transition from LIBOR and Alternative Reference Rates After the End of 2021

LIBOR will be replaced as the reference interest rate in Switzerland at the end of 2021. We explain the reasons for this, show alternatives and point out possible implications for institutional investors.

PPCmetrics Asset Manager Review 2019/2020 CHF Edition - English Version

Challenges and important aspects of illiquid investments. In the last three years, more than 3’000 investment managers participated in the PPCmetrics market screens. This Asset Manager Review contains information on asset managers for unlisted real estate USA, Swiss Equities Small and Mid Caps, Fund of Hedge Funds and Senior Secured Loans.

Illiquid Investments: Challenges ahead

Illiquid investments should appeal to pension funds because of their long-term benefits, but are opportunities equal?

Is faith in past winners justified?

Rankings of top performers are publicly available for retail funds. However, databases for institutional mandates (segregated accounts and institutional funds) are still incomplete and rare. For our historical simulation of picking past winners we use a set of track records that were submitted by asset managers as part of public and non-public mandate tenders for institutional clients in Europe.

Asset Liability Management Today – Is it Still ‘Fit for Purpose’?

The target of asset liability management is to align the assets to the liabilities, i.e. managing risks due to mismatches between the assets and liabilities.

Challenges Pension Funds Face due to Low Interest Rates

Risk-averse asset-only investors should go for short duration as risk return is distributed highly asymmetrically.