At a glance

-

Combined expertise in assets & liabilities by financial market and pension fund experts/actuaries

-

Modern, customized and interactive analysis tools for investment strategy definition and asset liability management (ALM) for institutional investors (pension funds, insurance companies, trusts, NPOs, companies, etc.) and private investors (private clients, UHNWI, family offices, etc.)

-

More than 100 projects per year concerning investment strategies

-

Strong client involvement in the formulation of solutions yields comprehensible recommendations (no black boxes)

-

Analysis of various parameters such as risk capacity, willingness to take risks, risk premiums, actuarial, economic or risk-bearing funding ratio, fluctuation reserve, minimum rate of return, investment risks, interest rate risks, performance, etc.

-

As an independent advisor and investment consultant, we strictly avoid conflicts of interests

Video – Investment Strategy / Asset Liability Management

Investment strategy

Various academic analyses show that performance differences can generally be explained by different investment strategies. Therefore, a specified investment strategy is essential.

Professional risk management requires extensive analysis of assets and liabilities. The success of the investment strategy largely determines the achievement of the investment goals. Asset and liability management is thus one of the core responsibilities of institutional investors (e.g. pension funds). In contrast, private investors strive primarily for value preservation and stability when formulating an investment strategy.

Setting investment targets

Establishing the minimum rate of return and its determinants, taking different scenarios into consideration, e.g. regarding contributions, benefits and costs as well as the evolution of the pool of insured persons or depending on the target performance.

Risk profile analysis

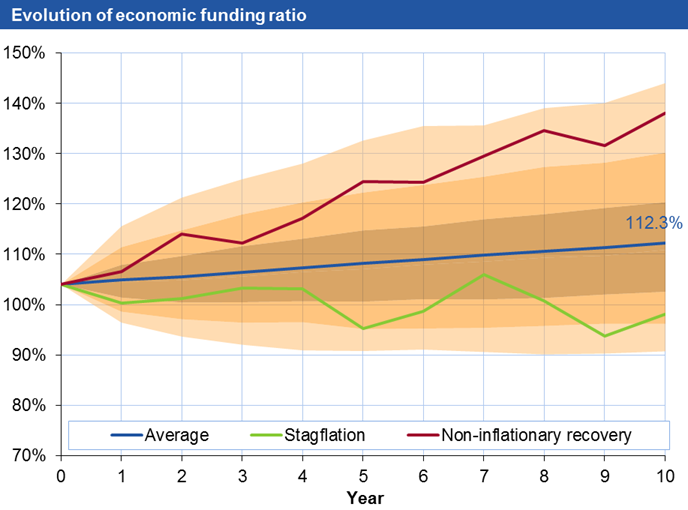

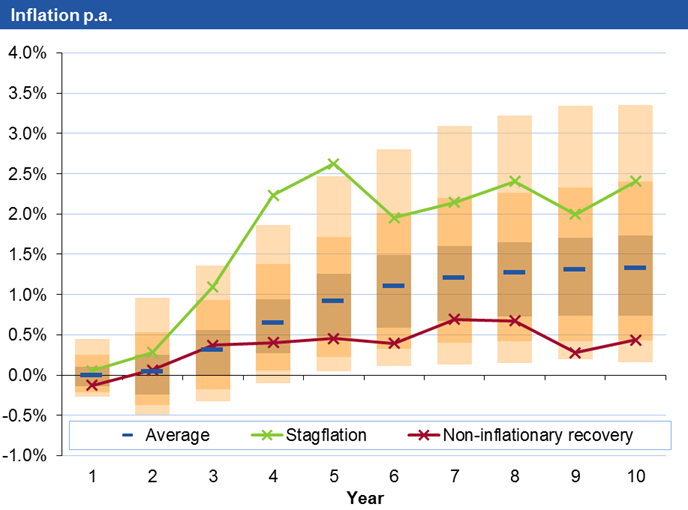

The risk profile shows which risks an institutional investor can offset on his own or at best through additional contributions by the risk-bearers. It provides the basis for formulating an appropriate investment strategy. The effects of stabilization measures are analyzed and quantified (see above graphs).Asset liability management (ALM)

Analyzing the characteristics of assets and liabilities shows the extent to which liability risks can be offset through appropriate investments. These risks are therefore contemplated from the perspective of overall balance (integrated risk management).Determining asset allocation

The economic characterization of liabilities allows for the formulation of an appropriate investment strategy geared to those liabilities.Publications

Challenges and Approaches in Performance Analysis of Illiquid Assets

What challenges arise from the valuation of illiquid assets? What are the implications for investors? And what approaches can be used in performance analysis? Our Managing Consultant Marc Staub answered these questions among others at the IPE Seminar.

UBS Takeover of Credit Suisse

On the evening of 19 March 2023, UBS announced its intention to fully acquire Credit Suisse in close coordination with the Swiss Financial Market Supervisory Authority (FINMA), the Swiss National Bank (SNB) and the Swiss Confederation. According to the SNB's press release, the transaction is necessary to secure financial stability and protect the Swiss economy. In our presentation, we summarise the most important facts about the takeover as well as possible implications for investors.

Current Facts About Credit Suisse

Distortions at the banks in the USA as well as statements by major Credit Suisse shareholders led to renewed high price declines in Credit Suisse's bonds and shares. The bank's stability is particularly at risk if it enters a negative spiral and is confronted by a significant outflow of client funds. In a media release on 15 March 2023, the Swiss National Bank SNB and the Swiss Financial Market Supervisory Authority FINMA commented on the uncertainties in the market as well as on Credit Suisse.

SNB Policy Rate Hike and General Interest Rate Increase: Impact on institutional investors (in particular Swiss pension funds)

Market interest rates have risen significantly since the beginning of the year and the capital markets have lost markedly in value. On 16.06.2022, the Swiss National Bank (SNB) also decided to raise the key interest rate and the deposit rate for commercial banks by half a percentage point. The presentation by PPCmetrics shows the effects on institutional investors - especially Swiss pension funds.

Shifting from fixed income

Swiss pension funds are rebalancing their portfolios but allocating to certain asset classes could prove challenging.

Transition from LIBOR and Alternative Reference Rates After the End of 2021

LIBOR will be replaced as the reference interest rate in Switzerland at the end of 2021. We explain the reasons for this, show alternatives and point out possible implications for institutional investors.

Interest Rate and Inflation Risk: How Are Pension Funds Affected?

The topic of inflation is currently in the spotlight. Our article looks at the economic context and the historical and current interest rate and inflation risks. It also shows to what extent Swiss pension funds are affected by interest rate and inflation risks and to what extent such risks are acceptable for them.

Tail-risk hedging lessons from the corona crisis

The coronavirus crisis illustrates that equity collar strategies may still have a place for pension funds.