At a glance

-

Tailored solutions for all types of foundations (grant making foundations, operating nonprofits, family foundations, non-profit organizations etc.)

-

Comprehensive range of of investment consulting services (distribution policy, investment strategy / asset liability management (ALM), investment policy statement, strategy implementation, sustainable investing, impact investing, selection of banks as well as asset managers and investment controlling)

-

Proprietary model for setting a realistic distribution policy

-

Practice-oriented implementation of sustainable investments

-

Custom-tailored, efficient support for any asset volume

Foundations and nonprofits

Foundations and associations face a variety of challenges, for example statutorily prescribed asset preservation, fluctuating investment returns, reputational risks, and limited human resources. Through targeted support, we help your organization attain its investment and financial goals.

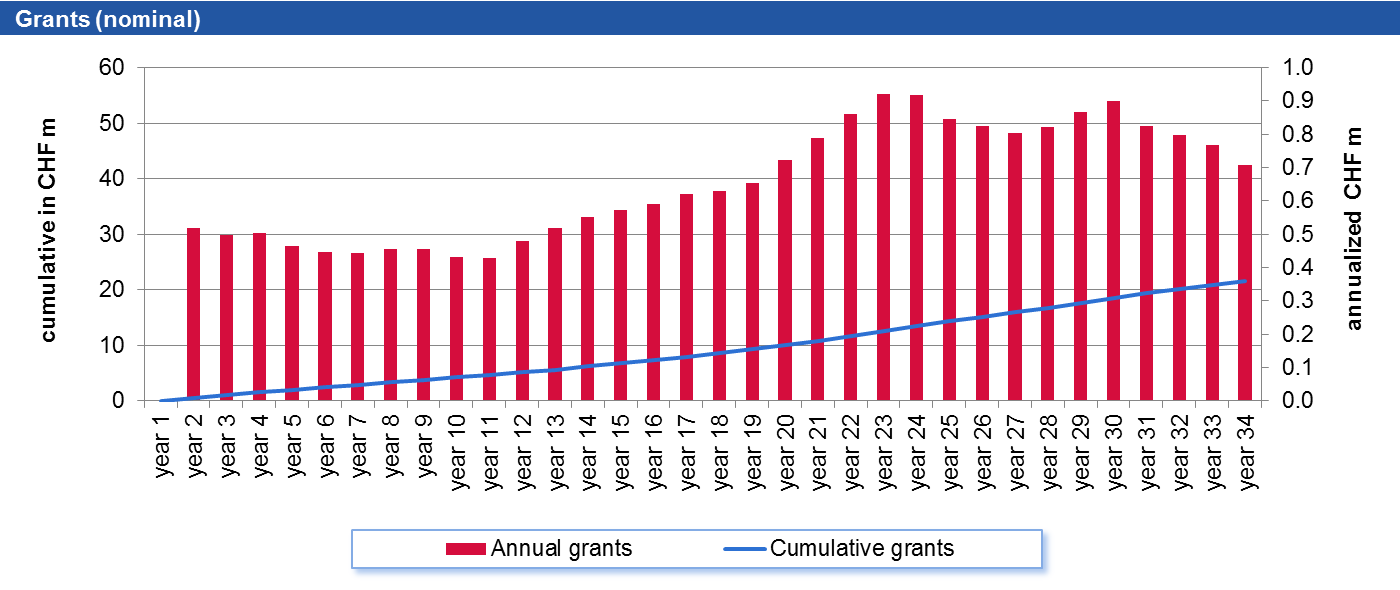

1. Distribution policy

We support you drawing up a distribution policy in accordance with investment targets (e.g. preserving real value) and the investment strategy. Our proprietary model enables a grantmaking foundation to maintain long-term financial balance (see above chart).

2. Investment strategy and asset liability management (ALM)

We help you determining a strategic asset allocation that reflects both the organization’s risk profile and the risk appetite of the trustees (asset liability management). The aim is that the strategy can be pursued even during investment market downturns.

3. Investment guidelines

Determining a concise yet customized investment policy statement, primarily specifying the responsibilities of the different bodies as well as the investments permitted (investment guidelines). They serve as the basis for awarding mandates to asset managers.

4. Strategy implementation

Together with you, we develop the mandate structure best suited to you. Besides assessing whether mandates should be actively or passively managed, we also assess the extent to which the organization’s purpose is being served through “sustainable” investment.

5. Selection of banks and asset managers / renegotiation of asset management fees

The large number of asset managers makes it difficult to choose the most appropriate one. We offer a professional and systematic selection procedure and a thorough knowledge of the economic, operational and legal criteria and risks. Asset management and bank fees are also essential.

6. Investment controlling

PPCmetrics investment controlling is an efficient management tool for monitoring invested assets. Our tailor-made investment controlling report contains all relevant management information.

Publications

About us: Changes to the Management

In the interests of proactive organisational planning and even better coverage of client needs, the management of PPCmetrics AG will undergo some changes as of 01.01.2024. Further information can be found in our media release.

Challenges and Approaches in Performance Analysis of Illiquid Assets

What challenges arise from the valuation of illiquid assets? What are the implications for investors? And what approaches can be used in performance analysis? Our Managing Consultant Marc Staub answered these questions among others at the IPE Seminar.

UBS Takeover of Credit Suisse

On the evening of 19 March 2023, UBS announced its intention to fully acquire Credit Suisse in close coordination with the Swiss Financial Market Supervisory Authority (FINMA), the Swiss National Bank (SNB) and the Swiss Confederation. According to the SNB's press release, the transaction is necessary to secure financial stability and protect the Swiss economy. In our presentation, we summarise the most important facts about the takeover as well as possible implications for investors.

Current Facts About Credit Suisse

Distortions at the banks in the USA as well as statements by major Credit Suisse shareholders led to renewed high price declines in Credit Suisse's bonds and shares. The bank's stability is particularly at risk if it enters a negative spiral and is confronted by a significant outflow of client funds. In a media release on 15 March 2023, the Swiss National Bank SNB and the Swiss Financial Market Supervisory Authority FINMA commented on the uncertainties in the market as well as on Credit Suisse.

Illiquid Investments: Challenges ahead

Illiquid investments should appeal to pension funds because of their long-term benefits, but are opportunities equal?

Is faith in past winners justified?

Rankings of top performers are publicly available for retail funds. However, databases for institutional mandates (segregated accounts and institutional funds) are still incomplete and rare. For our historical simulation of picking past winners we use a set of track records that were submitted by asset managers as part of public and non-public mandate tenders for institutional clients in Europe.

Asset Liability Management Today – Is it Still ‘Fit for Purpose’?

The target of asset liability management is to align the assets to the liabilities, i.e. managing risks due to mismatches between the assets and liabilities.

Challenges Pension Funds Face due to Low Interest Rates

Risk-averse asset-only investors should go for short duration as risk return is distributed highly asymmetrically.

Investment Strategies in the Year 2013 - English Version

In the year 2013, there were losses in the bond markets, while equity markets had high positive returns. As a result, the investment results of the different strategies varied widely. Pension funds, which have fully used their risk capacity through a large equity exposure, were able to benefit from this market environment. In addition, currency hedging and investments in corporate bonds, small caps, and non-listed real estate were positive as well...