At a glance

-

Highly qualified economic and legal know-how from one source

-

Legal risk Management

-

Interdisciplinary, competent and targeted

Legal advice

The legal requirements and issues relating to institutional asset management are becoming ever more complex. PPCmetrics advises pension funds, other institutional investors and private investors bearing their specific needs in mind. The focus is on implementing regulatory guidelines and current best practice in an integral and client-oriented manner.

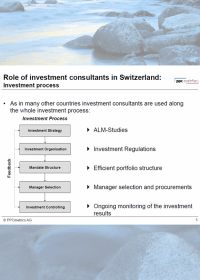

Investment process

- Legal support for bodies of institutional investors regarding investment organization and its implementation

- General legal advice for institutional investors

- Training staff members of institutional investors in legal matters

Legal Due Diligence

- Contract review

- Performing due diligence checks on collective investments/private equity/hedge funds, specifically developed for institutional investors

- Assisting institutional investors in governance issues such as organization, responsibilities, processes, handling/avoiding conflicts of interests

Contract negotiation

- Developing legal and economic specifications for asset managers

- Supporting or representing clients in contract negotiations:

- Asset management

- Global custody (including supplementary documents)

- Repo/securities lending (incl. GMRA, ISMA)

- Financial products (derivatives, collective investment vehicles, etc.)

- Legal assessment of investments in collective vehicles, private equity, hedge funds, etc. (Swiss and foreign law)

- Consultancy services and support in setting up and restructuring private label funds

- Second opinions on legal issues

- Preparing expert opinions

- Supporting institutional Investors in cases of disputes with parties charged with asset management

Publications

Challenges Pension Funds Face due to Low Interest Rates

Risk-averse asset-only investors should go for short duration as risk return is distributed highly asymmetrically.